Author: Robert Sarafov, Research: Loan Do

In our last E-News we published an article entitled ‘What the Royal Commission should have focused on but didn’t’. It touched on some issues of importance particularly in relation to Industry Super Funds. In this article we dig a little deeper to shine some light on some specific industry super fund practices and how all is not what it seems.

As an investor there are a few things that are important to know and understand when deciding to invest in, or remain invested in, a financial portfolio asset.

These include;

- What is the overall asset allocation of my portfolio?

- Is the investment risk within my comfort level?

- What are the specific investments I am invested in?

- What are the costs of my investment choice?

- What are my investments returns?

In an article published by ABC News on October 11th, 2018 the Hostplus Balanced Fund was heralded as the #1 ‘Balanced Fund’ in the market to June 30, 2018.

The article headlined ‘No retail funds make the top 10’. ‘Retail’ in this context means pre-packaged diversified portfolios marketed mainly by Banks, AMP and some others. As an aside, APC does not use these funds in any way, preferring to use lower cost wholesale investments.

Let’s consider these questions as we look more closely at the Hostplus ‘Default’ Balanced fund.

What is the overall asset allocation of my portfolio?

It is important to understand what is understood to mean ‘balanced’ in the Australian investment marketplace. It is a portfolio with an allocation to ‘growth’ assets (Shares, Property, Private Equity, Alternatives) of approximately 65%-70%. The remaining 30% – 35% is allocated to ‘defensive’ assets which the Australian Securities and Investment Commission (ASIC) defines as Cash or Bonds.

What allocation does the Hostplus Default ‘Balanced’ fund allocation look like? The yellow asset classes are considered by Hostplus to be growth and the blue are considered defensive.

The Hostplus Default Balanced Fund appears to have 75% allocated to growth assets however if you look at what Hostplus characterise as a defensive asset, Infrastructure and Direct Property are included which is simply not accurate. So this fund now has 90% in growth!

Additionally, it was impossible for APC to determine what ‘Other Assets’ and ‘Credit’ actually are. What we do know, from the Hostplus Default Balanced Fund allocation is that there is no allocation to the two assets that ASIC actually define as defensive, which is Cash and Fixed Interest assets.

So in reality, the Hotplus Default Balanced Fund is in fact a ‘High growth’ fund with a similar mix of growth and defensive assets to the APC Classic 100 portfolio.

Is the investment risk within my comfort level?

Given this disparity, Loan Do of APC contacted Hostplus on November 1st to query this and was told

‘PROPERTY AND INFRASTRUCTURE ASSETS ARE CONSIDERED DEFENSIVE DUE TO THE INCOME GENERATING NATURE OF THE PROPERTIES’

The position that because an asset generates income is therefore considered a ‘defensive’ asset is absurd. If this were accurate you’d consider Telstra and the Banks as defensive because of their current high yield!

Interestingly, on pages 74 and 82 of the Hostplus 2017 Annual Report Hostplus themselves characterise (correctly) that their own property sector investment risk is ‘High’ and that the investor should expect ‘a negative return 4-5 years out of every 20’. Does that sound defensive?

On the issue of the fact that their default ‘Balanced’ portfolio has no allocation to Cash or Fixed Interest assets at all Loan Do of APC was told ‘CASH AND FIXED INCOME IS 0% AT THE MOMENT BECAUSE THE PORTFOLIO MANAGERS BELIEVE THAT THERE ARE OTHER INVESTMENTS THAT ARE MORE VALUABLE TO INVEST IN’.

Presumably this is the ‘Other Assets’ that we are unable to find a description of what they actually are.

Given that 90% of Hostplus investors are in their ‘default’ balanced portfolio, do they understand that the ‘Balanced’ fund they are invested in is in fact a ‘High Growth’ fund with very different risk characteristics?

To put this into an APC context, this would be like a client who is invested in a Classic 70 portfolio being changed to a Classic 100 without their knowledge! It would simply not happen and would be completely inappropriate if it did.

What are the specific investments I am invested in?

As an investor, it is important to be able to understand what you are actually invested in. This goes beyond a high level understanding of the ‘Strategic Asset Allocation’ of your portfolio to having a deeper knowledge of individual investments that make up your portfolio. This information should be easy to access and understand. APC highlights this information in our Regular Planning Meetings.

Hostplus identifies some of this information on page 94 of their 2017 annual report which an investor needs to download and then review. It includes an investment list for Australian / International equities and Infrastructure. The Private Equity and Property information is high level only with geographic location and overall strategies or sectors covered but no specific investments. Alternatives, Other Assets and Currency (10% of the portfolio) has no information at all other than a generic series of paragraphs on page 108.

However what is not disclosed anywhere are the specific assets of the Hostplus Default Balanced Fund. It is simply not possible to understand if you are an investor in this portfolio, beyond a high level strategic asset allocation, what you are actually invested in.

It is a similar experience for other major Industry Super Funds.

Unlisted Assets

In addition to the issue of deceptive asset characterisation, the extensive use of ‘Unlisted Assets’ in Industry Super needs to be canvassed as an investor. Loan Do of APC confirmed with Hostplus that 40% of the Hostplus Default Balanced Fund is invested in Unlisted Assets! APC’s own review of the current Strategic Asset Allocation put that figure at 45% (see table below).

Investing in Unlisted Assets is in and of itself not an issue and is a legitimate investment strategy. However allocating such a significant portion of a portfolio to unlisted assets is something APC would not advise given the importance liquidity and investment flexibility play in a portfolio. Illiquid assets by their very nature are difficult to manage when economies and markets become volatile. For this reason APC would advise to not allocate more than 15% of a portfolio to this type of investment.

What was also not clear was the valuation methodology being used and its frequency.

Hostplus confirmed they used the Net Asset Value (NAV) methodology but could (or would) not elaborate on the basis used to determine the current market value of unlisted assets in their portfolio. So an investor cannot determine if the value of their share of an unlisted asset in their portfolio is in fact an accurate reflection of the value of that asset in an open market.

An example of how this can play out badly for investors is best illustrated by the Industry Super Fund MTAA which at the height of the GFC had approximately 60% of its portfolio invested in Unlisted assets. Not surprisingly it was top of the performance charts when listed markets were falling in value. However it went from the top of the performance table soon after the GFC to the bottom quite quickly after the Australian Prudential Regulatory Authority (APRA) introduced new rules to force Industry Super funds to re-value unlisted assets more frequently. MTAA (and other Industry Super and large corporate funds) simply chose not to revalue unlisted assets while the listed market was falling post the GFC. In this environment it was easy to understand why relative performance of funds that behaved in this manner was superior but it was a false dawn and many investors got caught.

Are the other large Industry Super Fund Default investment options any different to Hostplus?

What are the costs of my investment choice?

Investment cost is an important consideration. Many Industry Super funds negotiate with investment managers a lower Indirect Cost Ratio (ICR) in exchange for an investment manager ‘performance fee’. This was Industry Super’s dirty little secret before regulators forced industry participants to expressly declare it.

Let’s compare the Hostplus Default Balanced Fund and the APC Classic 70’s total investment fees.

* APC’s Investment Management Fee is based on a portfolio balance of $1m. As portfolio values change this percentage changes. For example with a portfolio value of $500,000, the APC Investment Management Fee is 0.42%. At $1m the APC Investment Management Fee falls to 0.31% and at $2m to 0.22% beyond which it attracts no Investment Management Fee at all. The Hostplus fees remain consistent irrespective of portfolio balance.

What are my investments returns?

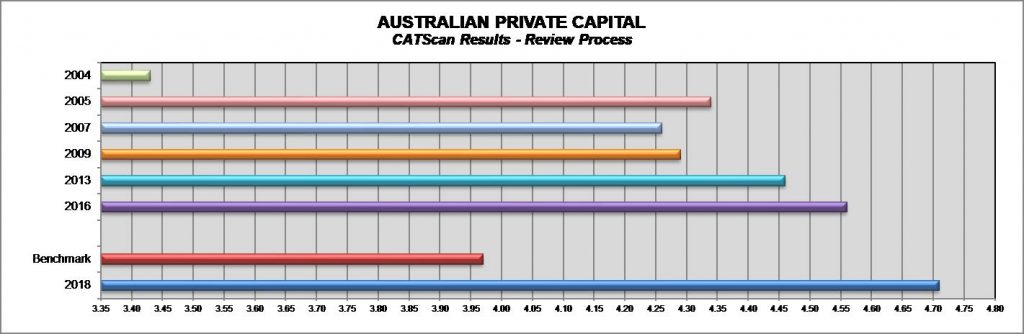

So, if we take a look of an ‘apples for apples’ comparison or the Hostplus Default Balanced Fund (which we know is a high growth fund) and the APC Classic 100 how do they perform to June 30th 2018?

**Performance is net of all fees with a portfolio value of $1m.

Recently there was an article in The Financial Review titled ‘Unions Challenge Labor to turf banks out of super’

A statement from the article was of particular interest.

“Industry (Super) fund members enjoy lower fees and are free from conflicted financial advice. The industry fund investment philosophy emphasises long term value and trustee diligence.”

Let’s deconstruct the various components of this statement;

- Industry (Super) fund members enjoy lower fees – Well that depends on what you are comparing them to. If comparing to high cost retail funds, which quite frankly are easy targets, the statement may be true. However when compared to wholesale investment management fees this is simply not the case.

- free from conflicted financial advice – If you call Hostplus (or any of the Industry Super funds), can you get advice about any other investment in the marketplace other than their own product? For example, would they advise you to take a look at another Industry Super fund product because it has lower performance fees?

The answer is clearly no. Is this not conflicted? Is this not the very vertical integration model that is being levelled at the Banks as being conflicted?

- The industry fund investment philosophy emphasises long term value – Industry Super funds invest in direct property via an Industry Super fund owned investment vehicle called the ISPT or Industry Super Property Trust. Mr Jack McGougan (former head of property at AustralianSuper) is currently suing his former employer for unfair dismissal. McGougan claims he was ‘pressured’ to invest member’s funds in the ISPT rather than other property assets which he presumably felt were a better (or lower risk) investment.

Irrespective of the outcome of the case, it raises some questions;

- Is it a conflict for Industry Super funds to invest member’s super into an investment vehicle that Industry Super funds own?

- Is this similar to the conflict that exists for Bank adviser’s recommending bank owned products?

- How is this conflict reconciled with an investment philosophy which aims to deliver ‘long term value’ for the interests of members exclusively?

- and trustee diligence – Industry Super has been fighting the Government tooth and nail to resist the call for independent directors sitting on Industry Super Fund Trustee Boards…why? All trustee boards, irrespective of whether they be overseeing the management of Industry, Retail or Corporate Super funds should have a representation of independent board members to ensure member interests come first.

Would an independent board member of an Industry Super fund approve of the donation of millions of dollars to the union movement? Is this in the interest of the Industry Super fund members?

Summary

Given the amount of analysis required by APC to better understand the answers to the questions canvassed in this article, it is highly unlikely an individual investor would have clarity around these issues.

Yet they are important and in Australia for whatever reason there is a compliant and apathetic media not addressing them nor a regulatory environment that seems interested. The banks and AMP are the obvious focus of the Royal Commission at this moment in time.

APC prides itself on transparency and providing as much information to our clients as possible such that they may better understand their strategy and investments in order to make informed and educated decisions.

As always, we welcome any queries from our clients and encourage you to make contact.